HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw. Unfortunately, he’s addicted to collecting extremely rare 18th century guides to bookkeeping.

Great! The Financial Professional Will Get Back To You Soon.

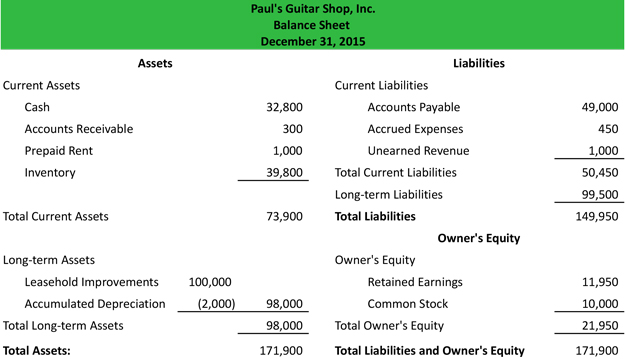

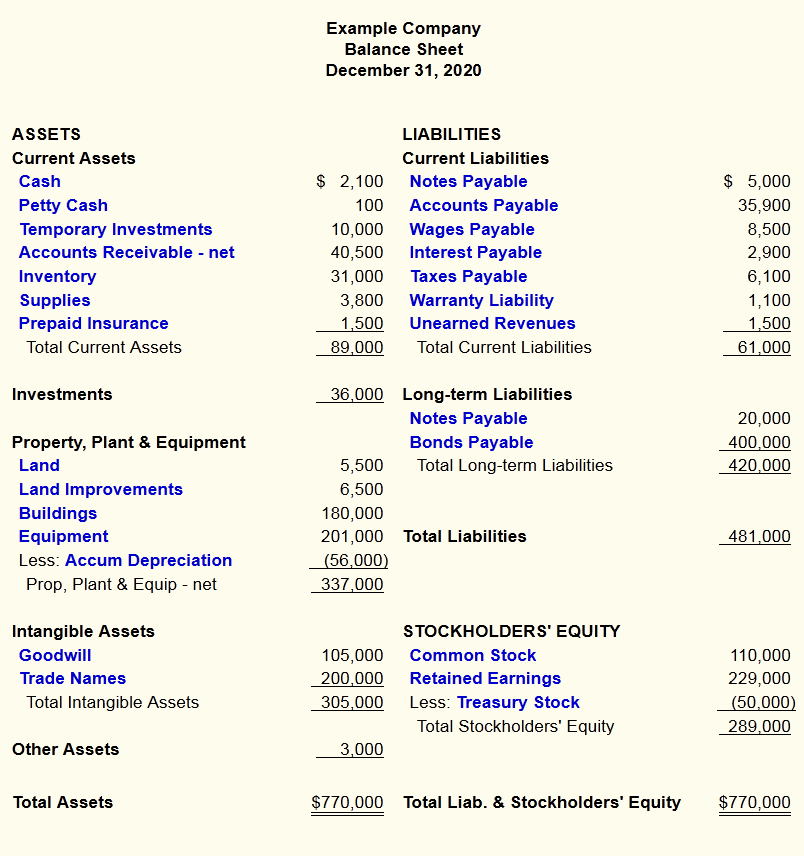

Balance sheets are one of the most critical financial statements, offering a quick snapshot of the financial health of a company. Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization. A balance sheet represents a company’s financial position for one day at its fiscal year end—for example, the last day of its accounting period, which can differ from our more familiar calendar year. While an asset is something a company owns, a liability is something it owes.

Shareholder Equity

If a company or organization is privately held by a single owner, then shareholders’ equity will be relatively straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued. Have you found yourself in the position of needing to prepare a balance sheet? Here’s what you need to know to understand how balance sheets work and what makes them a business fundamental, as well as steps you can take to create a basic balance sheet for your organization.

Who prepares balance sheets?

These financial statements can only show the financial metrics of your company at a single moment in time. While this is very useful for analyzing current and past financial data, it’s not necessarily useful for predicting future company performance. By comparing your income statement to your balance sheet, you can measure how efficiently your business uses its total assets. For example, you can get an idea of how well your company can use its assets to generate revenue. The difference between a company’s total assets and total liabilities results in shareholders’ equity (or “net assets”).

- The second source of funding—other than liabilities—is shareholders equity (or “stockholders equity”), which consists of the following line items.

- A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time.

- To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

- By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

Comparing two or more balance sheets from different points in time can also show how a business has grown. A balance sheet shows only what a company owns (and owes) on a specific date by displaying assets, liabilities, and equities. An income statement, on the other hand, what are the different types of ledger books with pictures reports revenues and expenses over a longer period. Balance sheets are used to determine if a company can meet its debt obligations, while income statements gauge profitability. A balance sheet is one of the most essential tools in your arsenal of financial reports.

Stocks

This ratio indicates that the company is significantly leveraged, which may pose risks, especially if interest rates increase or if the company faces a downturn in revenue. In general, high leverage can lead to greater financial risk and affects the company’s solvency profile. QuickBooks Online users have year-round access to QuickBooks Live Assisted Bookkeepers who can give personalized answers to bookkeeping questions and help manage their finances. Schedule a free consultation to get pricing details and walk through the service. Now that you have an idea of how values are recorded in several accounts in a balance sheet, you can take a closer look with an example of how to read a balance sheet.

However, if you’re going to become a serious stock investor, a basic understanding of the fundamentals of financial statement usage is a must. This guide will help you to become more familiar with the overall structure of the balance sheet. A company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. Knowing what goes into preparing these documents can also be insightful. Unlike the income statement, the balance sheet does not report activities over a period of time.

You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time. If you need help understanding your balance sheet or need help putting together a balance sheet, consider hiring a bookkeeper. Although balance sheets are important, they do have their limitations, and business owners must be aware of them. It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags. Financial strength ratios can provide investors with ideas of how financially stable the company is and whether it finances itself.

Get a Wise multi-currency business account to accelerate your business growth. The image below is an example of a comparative balance sheet of Apple, Inc. This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior. Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt.