The dollar-value LIFO method permits companies to try not to compute individual price layers for every thing of inventory. All things considered, they can work out layers for each pool of inventory. In any case, at one point, this is not generally cost-effective, so it’s fundamental to guarantee that pools are not being made superfluously.

Dollar Value LIFO – Key takeaways

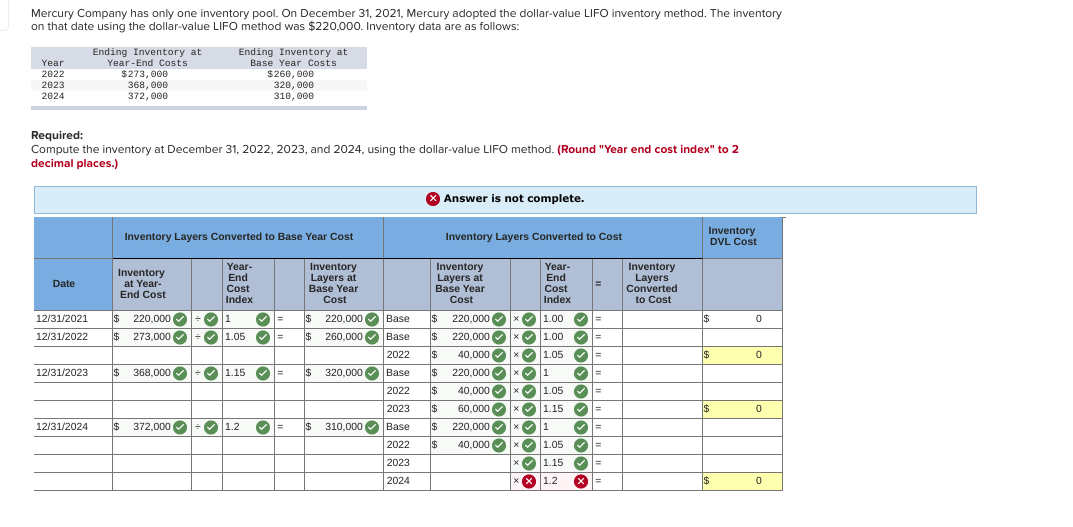

The focus in this calculation is on dollar amounts, rather than units of inventory. Companies that use the mortgage payment relief during covid method are those that both maintain a large number of products, and expect that product mix to change substantially in the future. Once the base-year cost is adjusted, the next step involves calculating the inventory layers. Each layer represents the increase or decrease in inventory value from one year to the next. These layers are then valued at their respective base-year costs, adjusted for inflation. This layered approach ensures that the most recent costs are matched with current revenues, providing a more accurate picture of profitability.

- New layer is added ONLY if ending inventory at base-year prices is more than respective year’s beginning inventory at base-year prices.

- This can make a company appear more profitable in the short term, which may be appealing to investors.

- Always consult with an accounting professional or financial advisor when dealing with inventory valuation.

- If you adopt the DVL method, you make a physical count of ending inventory and apply the proper DVL cost.

Products

This guide offers an in-depth view of Dollar Value LIFO inventory, including its advantages, disadvantages, and components to consider. Prepare yourself to conquer the job market with an enhanced understanding of Dollar Value LIFO. Explore the essentials of Dollar-Value LIFO, its calculations, and its effects on financial statements and accounting standards. If your business sells merchandise from inventory, your choice of cost flow assumption can affect your gross profits. The Internal Revenue Service allows you to use the first-in, first-out method or the last-in, first-out method — FIFO and LIFO. If you choose LIFO, you can further select from one of several submethods, including dollar-value LIFO, or DVL.

What is Dollar Value LIFO?

The dollar-value LIFO method is an inventory accounting approach where the latest inventory layers are assumed to be sold first, reflecting current costs in the cost of goods sold (COGS). This method is particularly beneficial for managing taxable income during inflation, as it adjusts inventory values to account for price changes, both inflation and deflation. If inflation and other economic factors (such as supply and demand) were not an issue, dollar-value and non-dollar-value accounting methods would have the same results. However, since costs do change over time, the dollar-value LIFO presents the data in a manner that shows an increased cost of goods sold (COGS) when prices are rising, and a resulting lower net income. When prices are decreasing, dollar-value LIFO will show a decreased COGS and a higher net income.

This method takes into account the total dollar value of the stock items, hence neutralizing the inventory valuation against the effect of inflation or deflation. The companies that maintain a large number of products and expect significant changes in their product mix in future frequently use dollar-value LIFO technique. The use of traditional LIFO approaches is common among companies that have a few items and expect very little to no change in their product mix. Under this method, it is possible to use a single pool but a company can use any number of pools according to its requirement. The unnecessary employment of a large number of dollar-value LIFO pools may, however, increase cost and also reduce the effectiveness of dollar-value LIFO approach. Companies that utilization the dollar-value LIFO method are those that both keep a large number of products, and expect that product mix to change substantially from now on.

Dollar-Value LIFO (Last-In, First-Out) is a specialized inventory valuation method that adjusts for inflation and changes in the value of money over time. This approach can significantly impact how businesses report their financial health and manage tax liabilities. The Dollar Value LIFO inventory method is used for calculating the cost of goods sold and ending inventory. It considers that the last items purchased are the first to be sold and adjusts for fluctuations in stock levels due to inflation or deflation. At first glance, the Dollar Value LIFO formula may seem a bit tricky, but once each component of the formula is dissected and understood individually, the understanding becomes effortless.

Unless the taxpayer secures the consent of the Secretary to the revocation of such election. If we assume prices at the beginning of the year to be 100% then prices at the end of the year are 125%. By the end of the year company had 1000 units of Item 1 and 5000 units of Item 2. Keeping comprehensive records of all transactions relating to your inventory and a clear log of calculations will not only facilitate easier calculations but also cater for any audits.

By valuing inventory at the most recent costs, this method often results in lower ending inventory values compared to other inventory valuation methods like FIFO (First-In, First-Out). This lower valuation can have a cascading effect on various financial metrics. To implement Dollar-Value LIFO, businesses first need to establish a base-year cost, which serves as a benchmark for future comparisons. This base-year cost is then adjusted annually to account for changes in price levels, using a price index.