It also helps the company keep thorough records of account balances affecting retained earnings. Revenue, expense, and dividend accounts affect retained earnings and are closed so they can accumulate new balances in the next period, which is an application of the time period assumption. Closing entries are posted in the general ledger by transferring all revenue and expense account balances to the income summary account. Then, transfer the balance of the income summary account to the retained earnings account. Finally, transfer any dividends to the retained earnings account. A closing entry is a journal entry that’s made at the end of the accounting period that a business elects to use.

Do permanent accounts get closed?

The records are used to generate reports that tell an owner how much money flows in and out of their business. Below are the T accounts with the journal entries already posted. We’ll use a company called MacroAuto that creates and installs specialized exhaust systems for race cars. Here are MacroAuto’s accounting records simplified, using positive numbers for increases and negative numbers for decreases instead of debits and credits in order to save room and to get a higher-level view. And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period.

Do you own a business?

Temporary account balances can be shifted directly to the retained earnings account or an intermediate account known as the income summary account. Essentially, all opening entries of a new fiscal year are the exact entries and figures of the previous period’s closing entries. Therefore, the beginning balance of these accounts can be taken from the previous period closing account balances. Permanent (real) accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity. These accounts will not be set back to zero at the beginning of the next period; they will keep their balances.

What Accounts Are Affected by Closing Entries?

Even if you ask your accountant to close your books for you, it’s important to understand the basic steps involved so you know what to expect. LiveCube Task Automation is designed to automate repetitive tasks, improve efficiency, and facilitate real-time collaboration across teams. By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors.

Introduction to the Closing Entries

We could do this, but by having the Income Summary account, you get a balance for net income a second time. This gives you the balance to compare to the income statement, and allows you to double the best accounting software for amazon fba sellers check that all income statement accounts are closed and have correct amounts. If you put the revenues and expenses directly into retained earnings, you will not see that check figure.

What Is an Accounting Period?

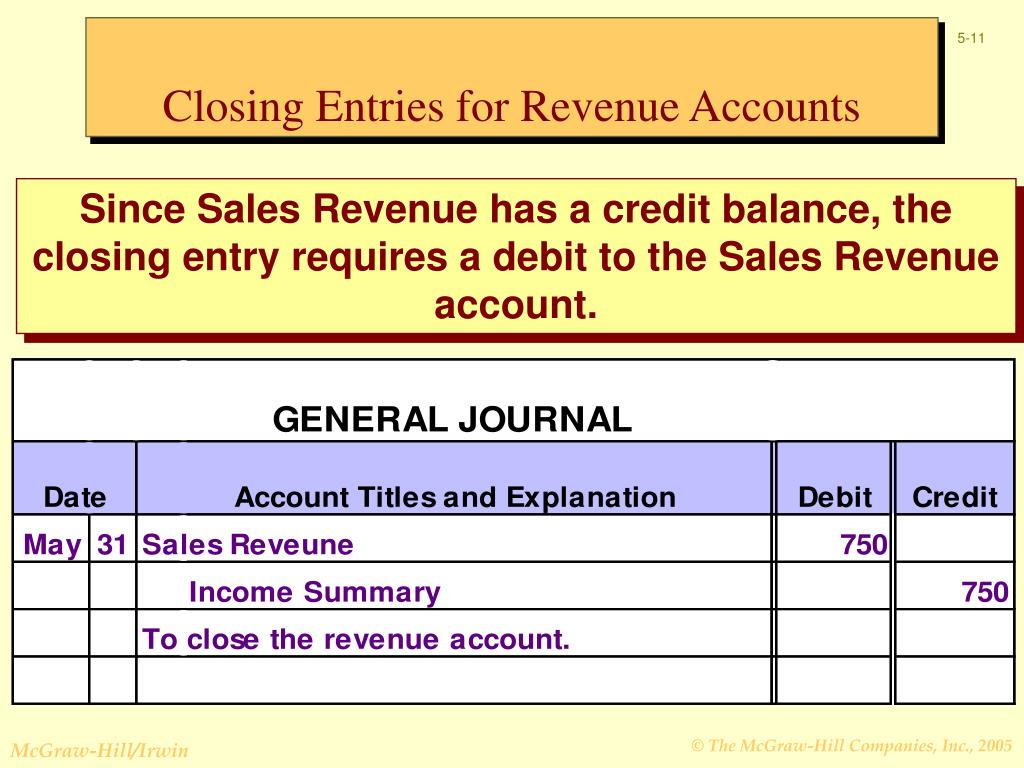

A closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings). The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements. These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period.

All opening entries should be recorded in the general ledger journal of the business and will represent the opening balance of accounts for the new period. The remaining balance in Retained Earnings is $4,565 (Figure 5.6). This is the same figure found on the statement of retained earnings. Our discussion here begins with journalizing and posting the closing entries (Figure 5.2). These posted entries will then translate into a post-closing trial balance, which is a trial balance that is prepared after all of the closing entries have been recorded.

However, you might wonder, where are the revenue, expense, and dividend accounts? These accounts were reset to zero at the end of the previous year to start afresh. On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below. Notice that revenues, expenses, dividends, and income summary all have zero balances.

- Temporary accounts are used to record accounting activity during a specific period.

- Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts.

- The first part is the date of declaration, which creates the obligation or liability to pay the dividend.

- We will debit the revenue accounts and credit the Income Summary account.

The business has been operating for several years but does not have the resources for accounting software. This means you are preparing all steps in the accounting cycle by hand. Closing entries are the journal entries used at the end of an accounting period. Your accountant often does these steps or uses professional accounting software to reduce errors. Once we have obtained the opening trial balance, the next step is to identify errors if any, make adjusting entries, and generate an adjusted trial balance. Remember that all revenue, sales, income, and gain accounts are closed in this entry.

No matter which way you choose to close, the same final balance is in retained earnings. Permanent accounts, such as asset, liability, and equity accounts, remain unaffected by closing entries. Closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period. Once adjusting entries have been made, closing entries are used to reset temporary accounts. The income summary account is a temporary account solely for posting entries during the closing process.

This makes it easier to do monthly tasks like bank reconciliation, sending sales tax reports to the state, paying your suppliers, and generating customer statements. Sum up the preliminary ending balances from the last step to make a trial balance. A trial balance is a report that adds up all the credits and debits in your business. You want your total credits to be the same number as your total debits—if they aren’t, go back and check your work. If the credits and debits are equal, your accounts balance, and you’re ready to go to the next step.